INTRODUCING

The Invest at REST Program

A comprehensive program to learn how to invest and implement right away.

Invest at REST is the only implementation program that shows you exactly how to grow your savings to achieve financial security, WITHOUT spending hours managing your portfolio (or worrying about it).

Clients & Guest Speeches

Before I tell you all about this life-changing program, let’s talk about who this is really for…

You’ve got money sleeping in the bank and you're frustrated with not knowing how to navigate the finance world. And you now feel it's time to invest and grow your savings toprepare for retirement, guarantee your financial security, and reduce how much you work..

And that’s whether …

-

You have an income and/or savings ...and you’ve started to think more about the long term, including your retirement. But you’ve not taken action because you’re so crazy busy juggling work and family (and also investing seems rather scary).

And you feel that you need to educate yourself a bit more and get some encouragement to make the first step.

-

You are already investing ...but you have this feeling that you still don’t really know what you’re doing. Or you want to optimize what you already have to make sure the result of your life’s hard work is well managed.

And you also want to understand what your financial advisor is actually doing with your money.

-

You’ve received a large amount ...due to a divorce settlement or inheritance. You now have the full responsibility to manage this money, and this is stressful.

You’re also getting worried about inflation and negative interest rates. And so you’d like to have more knowledge to make wise decisions, make the most of what you have, and grow it for the future.

-

You’re an expat living in Europe ...or a European expat living somewhere else, and you’re struggling to find reliable information on how to plan your financial life.

In particular, you start wondering how your retirement will look like, having contributed to pension systems in different countries, and even having a few years of missing contributions.

-

You’re a US citizen...and it seems that no financial institution outside the US will let you open an investment account.

And as much as you would like to grow your savings and plan for retirement, you’re afraid to mess up your US reporting and tax obligations if you start investing.

-

You’ve accumulated shares ...as part of your employer share plan and feel it’s time to diversify to be less reliant on your salary and employer.

But the world of investing is very unknown to you, and you need some help to figure it out. You’re also interested in learning how to invest while doing good.

By the end of this program you will have:

Completed an investment plan

You’ll have defined a customized plan which will include in what, how much, and where you’ll invest up until retirement and beyond. And that based on your specific situation, even as an expat, including with complicated tax matters, pension contributions in different countries, and multiple currencies.

Learned the ropes of investing

Learn step-by-step how to take advantage of the best and safest investment strategies as per what the research says. This way you can avoid making costly mistakes, safeguard your savings from inflation and grow them for the future.

Put your money to work

You’ll have started investing for yourself and your kids with confidence in a well-diversified sustainable portfolio generating market returns all of that using investment platforms and systems that don't require a lot of effort to maintain.

Taken control of your financial life

You’ll have acquired the knowledge and practical experience that you need to make all sorts of important financial decisions like buying a home or moving abroad. You’ll feel relieved that your money stuff is finally in order and that you're able to stand on your own two feet.

But above all else...

INVEST AT REST WILL

Give you the confidence to invest and grow your savings consistently over time.

Help you remain financially secure in retirement or after whatever life will throw at you.

Allow you to consider reducing how much you work and live a more balanced life.

" In a way, you changed my life...

I always do lots of mouth propaganda for you, Aysha, because in a way, you changed my life. You helped me understand how to invest and how to take care of money. You explain each topic very clearly, and I don't know anything like your program and support in Switzerland. And as a journalist, I dig deep."

-- Tamara Sedmak

German & Swiss TV-Host and Journalist

Plain and Simple: Invest at REST changes lives and you have the possibility to enroll now

(BUT NOT FOR LONG...)

A comprehensive program to prepare for retirement, learn how to invest, and implement right away.

Enroll at the SPECIAL BLACK FRIDAY OFFER price of € 1,850

(total value in excess of € 10,000)

Invest at REST

(Special Black Friday Offer)

Try Invest at REST for 30 days with a 100% satisfaction guarantee

“I joined the course, as I wanted to be managing my finances and understand what I was doing

...and feel comfortable about it. After the course, I was confident enough to re-organize our finances. I transferred our investment from a large bank to several robo advisory platforms. I have a clear strategy in place and spend about 30 minutes each month checking how much I can invest that month - This allows me to be flexible while still sticking to my plan and invest on a regular basis.”

-- Valerie A.

Zurich, Switzerland

"Once I delved into the course, I realized quickly how detailed the course was.

...I was a little hesitant to spend this amount of money on the course without really knowing how much I will learn more. I had read all of Aysha’s blogs and articles and felt like I already had a good idea of what the course would entail. However, once I delved into the course, I realized quickly how detailed the course was and how much I would have missed out on.

In addition, the money is worth every penny not only for the investments that I have placed (and the earnings accrued within the first 3 months) but also certainly for the confidence boost to actually take action and sort out our family finances and take control of our retirement and investments."

-- Ellen Montanari

Living in Spain and originally from Switzerland

“Since taking the course, I have a lot more confidence about my financial decisions.

I finally have the feeling that I know what I’m doing.”

-- Carina Rodriguez

Lived in Venezuela, USA, Panama and Colombia and now Switzerland.

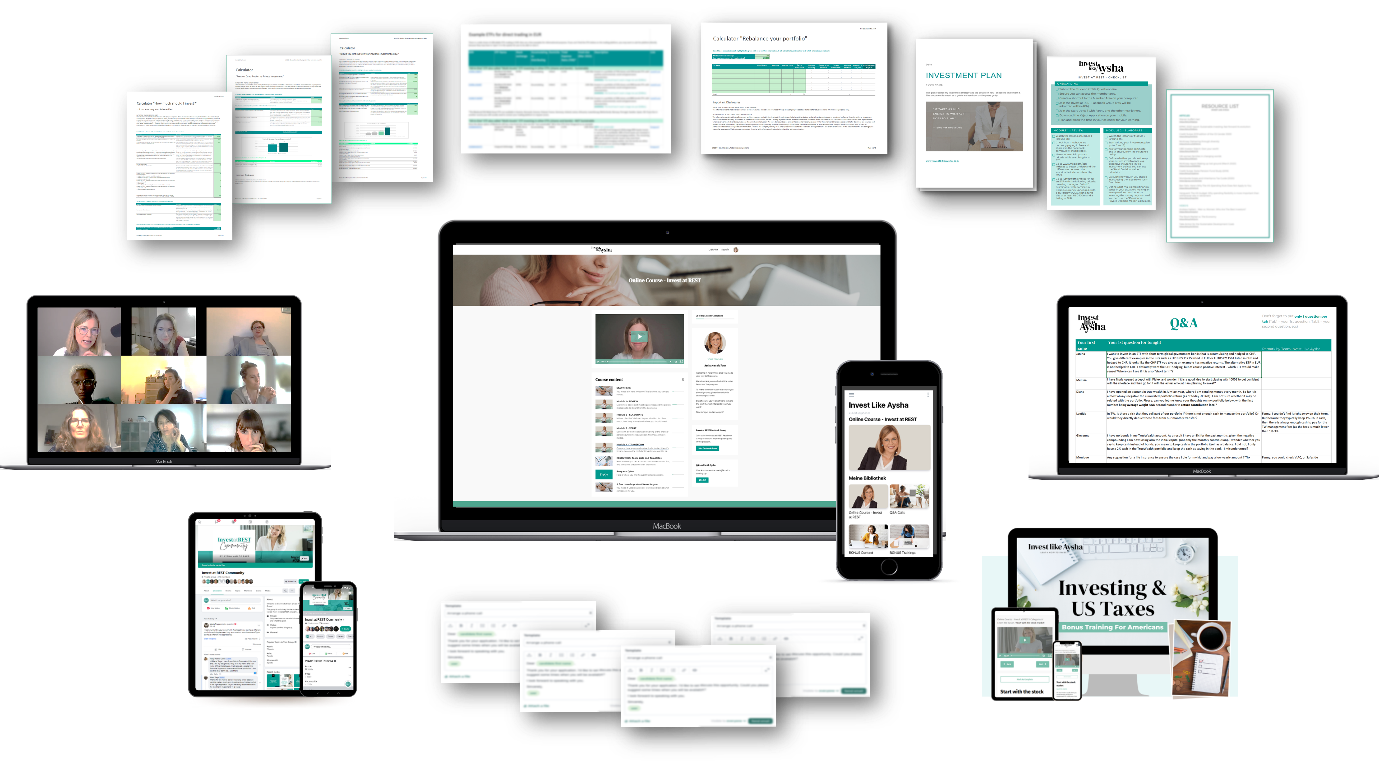

What’s inside the Invest at REST Program

Invest at REST consists of 4 core modules. The lessons consist of bite-size, step-by-step videos that you can watch whenever you can squeeze them in. The program also includes live Q&A calls twice per month and useful resources to jump-start your journey as an investor.

MODULE 1

REVIEW

Review the key investment concepts and best practices presented on very visual slides and with lots of concrete and down-to-earth real-life examples:

- Discover timeless investment principles and strategies based on what researchers have learned from 100+ years of stock market investing. Here I speak about the different components of your portfolio like stocks, bonds, gold and how they fit your portfolio.

- Do a deep dive on ETFs (Exchange Traded Funds) and index funds so that you can finally understand what they are, how they work, as well as their advantages and disadvantages.

- Discover the world of sustainable and gender lens investing and how they positively impact investment risk and performance. We will look at how you can invest sustainably and why this is key to the fight against climate change and other environmental and social issues.

MODULE 2

ELABORATE

Elaborate an investment & retirement plan that fits your specific personal, financial and professional situation.

- Consider the specifics of your life, including where you live, if you’re an expat, which language you speak fluently, as well as personal aspects like whether you’re married and have kids.

- Address headache items like how to compensate for missing or inconsistent pension contributions in different countries, what impact your different investments have on your taxes and how to deal with multiple currencies or move your money overseas.

- Define your investment strategy based on your preferences and determine exactly how much you need to invest and in what, how you will implement, how many accounts you need, where you’ll have them, and how to monitor your portfolio over the years.

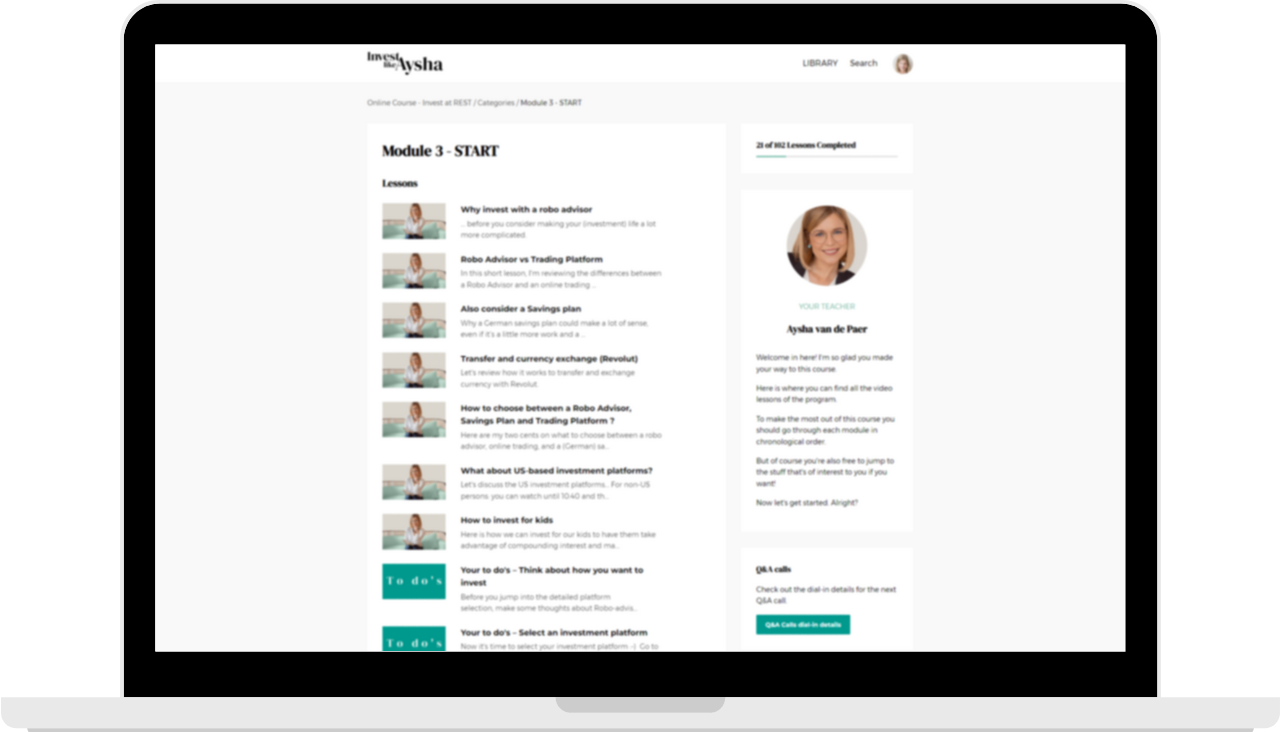

MODULE 3

START

Start to invest in alignment with your values on the investment platforms I recommend throughout Europe.

- Learn the differences between investment platforms and services, including online trading platforms, robo advisors, and savings plans to help you determine which kind of platform is best for you.

- Listen to me as I review the different platforms I recommend one by one and see how they differ in terms of fees and investment products. I also cover things like in which language they are available, which customers they serve (incl. if they accept Americans), and whether they’ll let you invest for your kids.

- Watch me open accounts and place transactions on various stock market platforms in demo videos to pick the ones that you like most and do the same in no time.

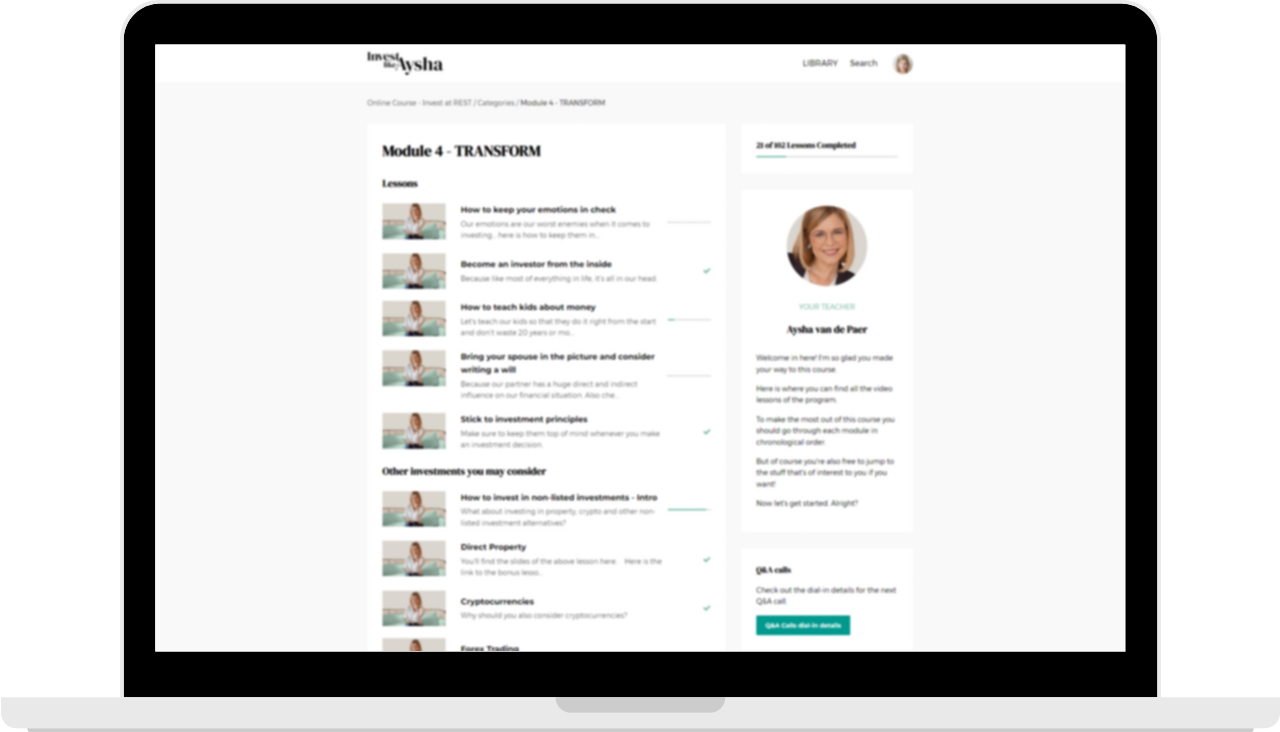

MODULE 4

TRANSFORM

Now that you’ve started investing and have a solid investment plan you can use as your north star, it’s time to dig into a few more topics to help you transition from amateur to confident investor.

- Work on your money mindset in terms of earning, spending, saving, and investing. Also learn how to keep your emotions in check during the inevitable stock market declines that will come your way so that you don’t screw up the great investment plan you’ve put together.

- Branch outside of the stock market and learn more about other types of investments, such as property, cryptocurrencies, peer-to-peer lending, crowdfunding, and forex trading.

- Consider how you can invest with more impact, with things like impactful banking, micro-loans, green bonds, as well as impact investment platforms and funds (especially if you have a large amount to invest).

- Discover how to put your partner in the picture to make personal finance and investing a joint project rather than a source of conflict. And see how you can teach your kids about money and investing early in life.

Q&A Calls

The program also includes group Q&A twice per month (access granted for one year)

- Get answers to your specific questions to apply what you learned to your individual situation, especially when things get complicated due to your expat lifestyle or US person status.

- Connect with other women in the program and learn from their questions and the answers they receive on items you didn’t even consider but that also apply to you. Get energized by their determination to sort out their finances and invest for the long run

- Keep optimizing your finances call after call to create a solid financial foundation that will accompany you for the years and decades to come.

Additional Resources

You'll also get access to an exclusive resource library to make sure you have everything you need to jump-start the implementation process, which includes:

- A proprietary database of recommended investment platforms across Europe, the UK and Switzerland (and selected US platforms that works for US expats) where you can invest in alignment with your values, You will be able to search this database as per your criteria (e.g. minimum investment, language, do they accept kids, etc.)

- Lists of example ETFs in EUR, USD, CHF, and GBP. The lists also contain sample ETF portfolios to show you how you can build your own at lightning speed.

- Calculator tools in which you can input the details of your situation and get a feel of how much you need to invest. You’ll also get to calculate if it makes sense to contribute extra to your pension fund and keep your existing investments such as life insurance policies.

- An investment plan template to get you started right away with creating your own plan. Use it also to keep an overview of all your investment accounts in one place.

ACCESS SPECIAL ADDITIONAL FEATURES!

You’ll also be able to access these special features to help you take full control of your finances

LET'S DO THIS!

Join Invest at REST Today

Enroll at the SPECIAL BLACK FRIDAY OFFER price of € 1,850

(total value in excess of € 10,000+)

Invest at REST

(Special Black Friday Offer)

*The optional US Expat Section is available at an extra cost of €450

INVEST AT REST

30-Days Money-Back Guarantee

Try Invest at REST for 30 days with a 100% satisfaction guarantee

I'm confident you'll LOVE this course, too. But if you can honestly say that it's not helpful, then I'll gladly give you a full refund within 30 days.

“I now have a plan and I’m ready to take action.

I am more conscious about my financial choices and I got more savvy about money and investing. And I also feel more secure that I am at last trying to build a secure financial future.

What I liked the most in the course, is how actionable it is: “go and do this.” I really loved that I could immediately apply what I had just learned in a lesson. And the community was great! I enjoyed reading through the questions and answers in the Facebook group. Also, I loved the Q&A sessions: they were extremely helpful.”

-- Anna Hart

German expat who lived mostly in the UK, and also in Canada and France before moving to Zug

“My favourite feature of the course was without a doubt the hands-on demos and tutorials.

I mean, in the end this is the “action” we need to take, and this is what I was the most scared of. But once you showed me how easy it is, my fears definitely got a lot smaller :)”

-- Lena Herring

German expat. Studied in the Netherlands and Paris, before moving to Zurich.

“So much has changed! My mindset (and my husband’s) totally changed

about saving vs. investing, risk-taking, the stock market, and pension planning. We both have opened new accounts and decided to close a few. We feel more in control of our financial future.”

-- Sara M.

Iranian expat living in Switzerland with her British husband.

"I think that 99.999999% of women I know (and also a lot of men, actually) would benefit from this course.

I’m a US cititzen and it helped me so much figure out how and where I’m able to invest here in Europe."

-- Rebecca K.

Expat based in Zurich with US, UK and Bermuda citizenship

MEET YOUR TEACHER

Hi, I’m Aysha van de Paer

I’m a financial professional with over a decade of experience in private equity and real estate investing in financial, investment, and consulting companies around the world.

Originally from Switzerland (despite my very “unswiss” name) I’ve lived the expat life, working and studying in the US, the UK, Netherlands, Germany, and the United Arab Emirates.

Why should you learn with me?

I lived in several countries, which means I’m familiar with the struggles of moving and managing money in multiple bank accounts, currencies, pension and social security systems in different countries and languages (I’m bilingual in English and French and speak German and Dutch more or less fluently).

My eldest son is an American citizen as he was born in New York. And with that, I’m confronted with the realities of American citizens abroad, including restricted access to investment services and US tax filings and compliance requirements.

I’m also a single parent of two after losing my husband Karl in a road accident in 2017. And so I had to face and learn very fast about things like inheritance proceedings and social security benefits, and how living the expat life makes all of that a lot more complicated.

Being a single parent and a professional woman also means that I have no time to spend hours and hours managing my investments and planning for retirement. And for this reason, the strategies and systems I recommend are all time-efficient to implement and manage.

And I don’t do this alone. Meet my sister Fanny.

I'm the oldest of four daughters, and one of them, Fanny, has joined me in this adventure.

Fanny is a certified accountant and has worked over a decade in finance, audit, and controlling at Novartis, a pharma giant, and EY, an international audit firm.

She started her career working for SVA, a Swiss social insurance company, and so she has a good grasp of all kinds of financial matters, including taxes and pension planning.

Fanny is also a passionate property investor and spent a few years in Mumbai, India, and half a year in Brisbane, Australia.

In addition to managing all the financial and admin side of the business, Fanny helps me ensure the program content is top-notch and always up to date.

“I already had a solid understanding of investing before joining the program

...having already started a Sparplan investing in ETFs years ago. Nevertheless, there is still so much more for me to learn! On the one hand, it’s great to get the acknowledgment that my own ideas were pretty good. At the same time, it’s great to improve the planning and to think about what I want to achieve and what my strategy is! The program also helped me to quickly understand the differences between Germany and Switzerland.”

-- Anja Person

German expat working in Basel

“The best in the course is Aysha’s passion

...and ability to explain things in a way that’s easy to understand - and that no question is too small or silly.”

-- Fiona McKerrow

Basel, Switzerland. Previously lived in the UK and Canada.

You know it’s time to make a change

The biggest mistake expat women make about managing money is knowing that it’s something important...

...BUT not making it a priority because they have other urgent stuff on their to-do list. And so they just end up pushing taking control of their finances to “later”

… for years, and even decades.

They keep going like this, relying on their job, partner, and retirement system while not knowing where they stand and hoping it will all work out in the end.

Guess in what kind of difficulties they usually end up…

- Having to dramatically lower their lifestyle once they retire.

- Not being able to retire early, or even having to retire later.

- Not being prepared in case of a divorce or when their husband or partner dies.

- Missing out on the magic of compounding interest, which is a mathematical formula that accelerates your investment returns the longer you invest.

- Always feeling unsure, worried, and hesitating to make important financial and life decisions because they have no clue where they stand financially.

And all of that will only get worse as time passes, especially if you live the expat life.

Pension funds and social security systems in developed countries are all facing major socio-economic issues.

The aging of the population, especially, is a little bit like a time-bomb for future retirees like you and me.

Unfortunately, governments are slow at making the required adjustments to deal with this problem.

And as a result, pension funds end up allocating a large chunk of the investment return on pension contributions to current retirees (and not to those like us who actually contribute the money).

This means two things:

- 1) your pension contributions are growing at a ridiculously slow rate, and

- 2) at some point, the clock will stop ticking, and people will have to retire (much) later on (much) less.

And there are other issues making things even harder to stay financially secure for retirement.

In particular, high inflation in the current economic environment is having a dramatic impact on your savings, which will easily have lost about half their value a couple of decades from now decreasing the value of your savings if you don’t do anything about it.

This is the last thing I want to happen to you, especially because you can avoid it by putting together a good plan and implementing it asap.

We just can't rely on the system when it comes to retirement.

We need to take matters into our own hands to make sure we get to live the life and retirement we so greatly deserve.

“I’m much less afraid of this monster I don’t dare to touch

...because I now have a plan that I can execute in steps (I’m in the midst of it). I finally got all the confidence I need to take care of my finances. I leave this course with full control of my investments and a clear, long-term plan for my pension.”

-- Franziska Fischer

Zurich, Switzerland

“During the course, I simply switched from analyzing and procrastinating to doing.

That’s the biggest impact Aysha’s course had on me. I have now invested in a robo advisor as well as directly in sustainable and gender-balanced ETFs on a trading platform. And I’m already doing the same for my mother, who can now escape expensive financial advice.”

-- Regina Vogel

German expat living in Dublin

“I finally started to invest. And now I think differently about money

...and how to spend it, and especially, how to invest it, instead of just saving it. I like that I now understand what I am doing and in what I am investing. I am no longer dependent on my husband to make these decisions.”

-- Francesca Barbera-Eckert

German expat living in Zurich

"I felt very upbeat and positive...

about my own ability to handle my finances without needing anybody telling me how I should proceed.

-- Irina Dalloz

Bulgarian expat living in Geneva

Ready to take control of your finances?

If you’re thinking “this sounds amazing but I’m still not 100% sure”

Then keep reading…

Because I get it. Investing is kind of scary. And this program is a serious investment. That’s why I want you to see the big picture.

- If you apply what you learn in this course, then based on the research over 100+ years of stock market investing you can expect your stock market portfolio to grow at an average market return rate of approx. 6%* per year, taking into consideration things like taxes, inflation, and investment fees.

- Some years it goes up nicely, and some years it goes down badly. But on average, that’s what you should get.

That means that your savings will grow way beyond the cost of this course

Considering an average market return of 6.5%* you may earn back what you will have spent for the program in a few months. For example:

- If you invest €20,000 now, and €200 every month thereafter, your portfolio should grow to approx. €240,000 (instead of just €80,000 if you don't invest)*

- If you invest €50,000 now, and €500 every month thereafter your portfolio should grow to approx. €600,000* (instead of just €200,000 if you don’t invest)*

- If you invest €100,000 now, and €1,000 every month thereafter your portfolio should grow to approx €1,190,000* (instead of just €400,000 if you don’t invest)*

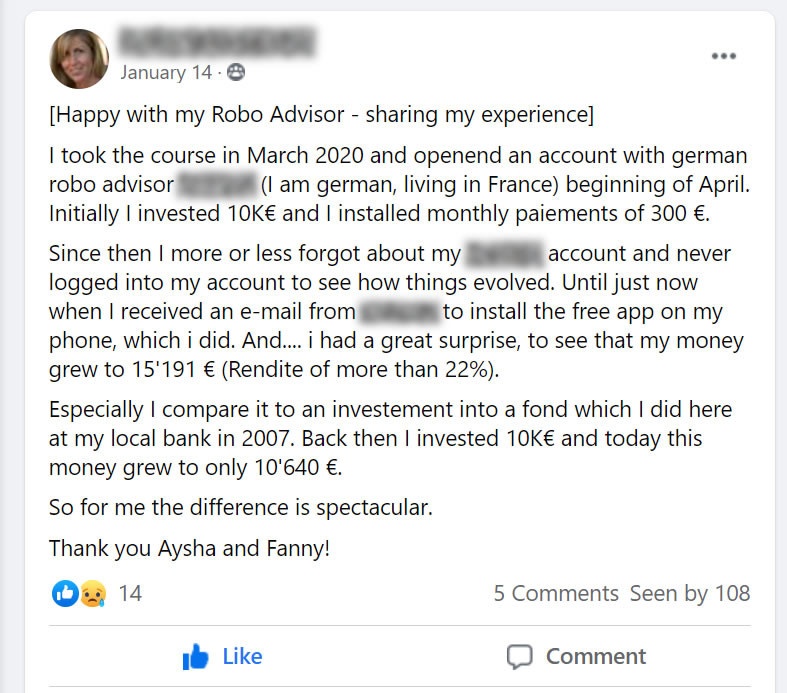

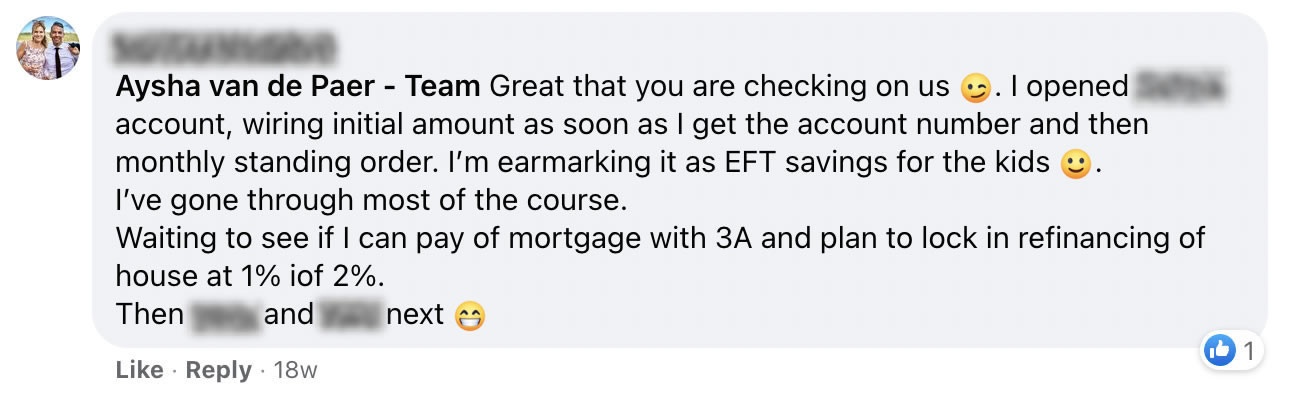

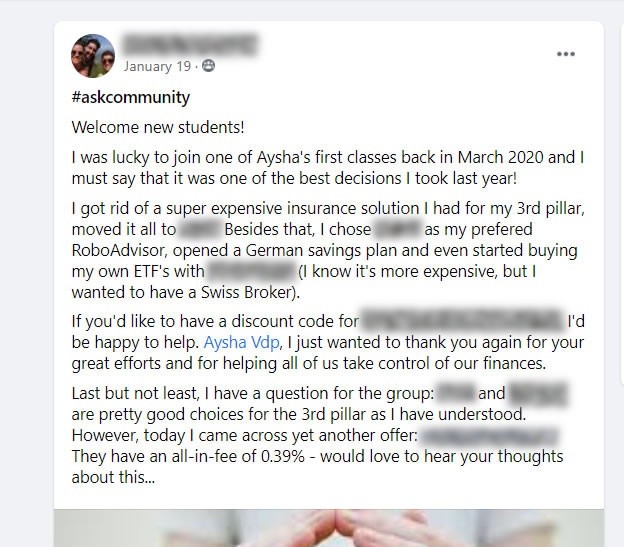

Here is some more feedback from students in the program

Below you can catch a glimpse of what the experience of current and prior students has been so far.

LET'S SUM IT UP

Here’s a recap of everything included in the Invest At REST Program

Module 1

Review and learn the key theoretical aspects of good investing with real-life examples, including all about ETFs and sustainable investments.

Value = €750

Module 2

Elaborate an investment plan that considers the specifics of your life and incorporates pension planning, taxation, and currency management.

Value = €750

Module 3

Start investing after learning all about the various investment platforms I recommend for expats and US citizens in Switzerland and Europe.

Value = €750

Module 4

Transform into a confident investor, look at investments beyond the stock market, and put your partner and kids in the picture.

Value = €750

Q&A Calls

Ask me all your questions on how to apply the course material to your specific situation for the next 12 months during our group Q&A calls

Value = €6,000

Additional Resources

Download calculator tools, lists, and templates to customize what you learned and jump-start the implementation process.

Value = €1,000

Bonus Facebook Group

Join our private Facebook Group to interact with the other participants in the program.

Value = Priceless

Optional for US Expats

Learn where and how you can invest as a US expat, as well as the tax and regulatory requirements to consider

Additional cost = €450

When you add that all up, it comes out to a value of more than € 10,000

...but you can enroll today at a discounted BLACK FRIDAY price of for € 1,850

LET'S DO THIS!

Join Invest at REST Today

Enroll at the SPECIAL BLACK FRIDAY OFFER price of € 1,850

(total value in excess of € 10,000+)

Invest at REST

(Special Black Friday Offer)

Try Invest at REST for 30 days with a 100% satisfaction guarantee

"It's an effort to make once and then it is soooo satisfying!

Any person should do it when they are starting to earn money!”

-- Caroline Gueissaz

Neuchatel, Switzerland

“I now have a strategic long term plan in place

and it completely changed my approach to finances. I also feel more confident and in control of my future. This course has been an eye opener and very inspirational.”

-- Lauriane Mounard

French expat who lived in the UK, UAE and Thailand before moving to Lausanne, Switzerland.

HAVE A QUESTION?

Burning questions prior course participants asked before signing up

How long does it take to complete the course?

How long will I have access to the program?

Who is NOT a good fit for this program?

Are you affiliated with any financial party?

Will I get personalized recommendations about investing?

What do I do if I need support?

Will taking this course eliminate the need to hire a financial advisor?

When will the course start?

I already invest, will I still benefit from the program?

Does this course cover real estate investing?

I'm an American expat, can this program help me?

You know this is long overdue...

"I think the fees for the course that I have paid are one of the best investments

I started with the Invest at REST program. Although I am not done yet with the course and haven't invested anything yet, I just wanted to honestly say that I am SUPER thankful that I have stumbled upon Aysha and her knowledge that she offers to others! I think the fees for the course that I have paid are one of the best investments I have made in a long time."

-- Alona Elena Marchukova

Russian & German expat living in Zurich

The best time to start planning for retirement was yesterday. The next best time is today.

We all wish that we ALREADY started investing and growing our savings decades ago. And if you’re worried that your money stuff is not optimized, I hear you, and I’m here for you.

And to make matters worse, inflation is rising everywhere, which means that if you don’t invest, the value of your savings will decrease by anywhere between 25%-75% or more over the coming decades.

You read that right.

Although we don’t really feel or see it, inflation is eating away the value of our savings.

The financial impact of inflation is huge and very few economist and politicians dare to talk about it, nor do they really understand the concept. And so if you don’t invest, it is very likely that you won’t have enough to maintain your lifestyle once you retire. And in fact you may have to keep working for much longer than you planned.

This is why getting started with retirement planning and investing makes even more sense now.

So here is a suggestion...

What about taking it as an opportunity to finally start investing (or invest more and better)?

Because we both know that you’re a smart cookie and that you can learn and implement anything if you make it a priority.

Think about it:

What if just one module in the Invest at REST program helped you put (more of your) savings to work and get well prepared for retirement?

What if just a few lessons would help you invest in alignment with your values with minimal time and effort?

What would that be worth over your lifetime... $10,000, $100,000, $1,000,000 or more?

And so if it’s the right fit, I’d be honored to welcome you inside the program. Invest at REST has literally transformed the lives of 700+ women.

They learned how, where, and how much to invest based on their specific situation and could finally take control of their financial life.

At some point we all want to be in charge of our financial destiny, right?

And so instead of letting your savings just sit there, are you ready to:

- Take control of your finances,

- Stop being entirely dependent on your salary or your partner, and

- Prioritize yourself and your future for once?

You have everything to gain. It's time to stop all the analysis-paralysis. Start making the most of what you already have and prepare for retirement...

Don’t wait another year to do yourself this favor!

I can’t wait to meet you and cheer you on inside Invest at REST.

LET'S DO THIS!

Join Invest at REST Today

Enroll at the SPECIAL BLACK FRIDAY OFFER price of € 1,850

(total value in excess of € 10,000+)

Invest at REST

(Special Black Friday Offer)

*The optional US Expat Section is available at an extra cost of €450

Try Invest at REST for 30 days with a 100% satisfaction guarantee

IMPORTANT DISCLOSURES

***

*Return indicators presented on this page are not projections or guarantees of future performance, and there is no certainty that the target returns will be reached. Past performance is not a guarantee or indicator of future results. "Invest Like Aysha" is all about investment and financial education. The information made available in this course and related communications is provided for educational purposes only and do not constitute investment advice nor financial advice. Read the Terms for further important disclosures.